Difference Between Gambling And Investment

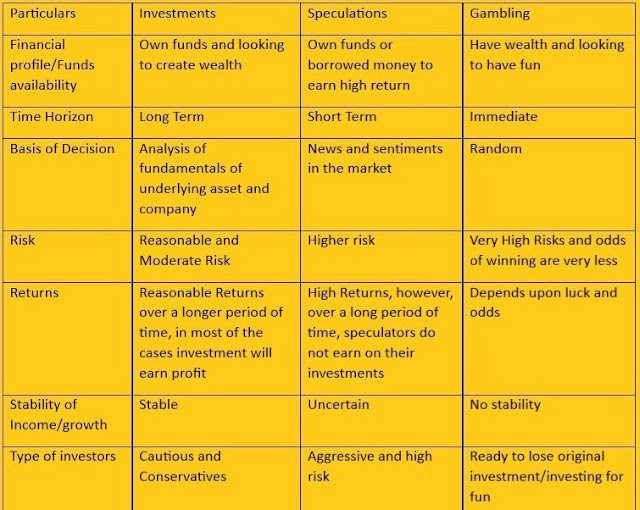

- Difference Between Investment Speculation And Gambling In Tabular Form

- Difference Between Gambling Investment And Speculation

- Difference Between Investment And Gambling Slideshare

What’s the difference between investing vs. gambling? Well the simple answer is math, but there’s more to it than that.

In my mid-teens, I went to Atlantic City with my family for an evening on the boardwalk. I was deeply interested in money for someone my age, so gambling intrigued me.

You must be over the age of 21 to enter the casino floor in Atlantic City, but kids are allowed inside the hotels. We entered one of the glitzy hotels owned by a certain famed politician at the time, and my parents went to play a few slots.

Jun 18, 2008 Can you explain the difference between gambling and investing? Thanks in advance. Thank you for your e-mail and question about the differences between gambling and investing. There are a number of Christian authors who have addressed this. There is often some confusion between the terms investment, speculation and gambling. Gambling and investment have a lot of similarities and you can find a quite difference between both of them. Investment is something you give your money or you place your money on something which you are planning to buy them. Investments for retirement accounts tend to aim for steady growth over the long run. You’ll find that 401K investment options are highly regulated and often limited to diversified funds. Difference Between Gambling and Investing. On the surface, gambling and investing may seem alike in some ways. As your investment time horizon increases, so does your chances of earning 9%, especially if you’re investing in low-cost index funds and Dividend Aristocrat stocks in retirement accounts. Another major difference between investing and gambling is ownership. When you buy a stock, you become a part-owner of a business.

Hours earlier at the beach house, I gave my Mom $3 in quarters and asked her to play them for me in a slot machine. I gave her strict instructions to play one quarter at a time and to walk away with the proceeds after playing all 12 coins.

I watched from a distance as she followed my instructions. She came back with about $5. I was disappointed to not hit the jackpot but proud that my strategy returned a profit.

Since I thought I knew a lot about money, I believed I’d be good at gambling too.

Clearly, I had a lot to learn about investing vs. gambling.

Math

After a decade of attending bachelor parties in Atlantic City and Las Vegas, I learned that I’m bad at gambling.

I lack the discipline to play “like you’re supposed to” in blackjack.

The one time I tried craps, I crapped out to the tune of $100 in less than five minutes.

Slots are fun. But terrible outcomes are inevitable.

Almost everybody sucks at gambling — because of math.

The longer you spend gambling at a card table, roulette wheel, craps table, slots, or whatever game you like, the more likely you will lose money.

Before some of you get defensive, I’m talking about gambling against the house. I understand that there’s an element of skill for certain card games such as Texas Hold’em Poker when you play against other people.

The biggest sucker at the table loses.

There’s also some card counting and stealth partnering skills that can be applied to blackjack that may give a very small minority of players a slight advantage over the house.

But that doesn’t apply to 99+% of gamblers.

There’s a certain kind of machismo you see at casinos. “High rollers” dress nicely and look as though they know how to win. That kind of behavior might attract an audience for the evening, but probably not a profit.

Nearly all of us lose eventually. So the key is to gamble for fun, set a firm limit, know when to quit, and not develop an unhealthy addiction.

Despite being bad at gambling, I still love casinos.

I love the aromas piped into the lobby, the free drinks, the extravagant bars and nightclubs, the bustle, and the camaraderie at the pai gow table.

I enjoy a visit to the horse betting room, knowing that I’ll walk out with more money in my pocket than nearly everybody else without placing a bet.

Casinos are the perfect vice for a night of drinking, gambling, and entertainment without the kids. That’s my kind of fun every once in a while.

Investing vs. Gambling

Investing is not gambling if it’s done properly. Gambling is certainly not investing.

Here’s how the Merriam-Webster dictionary defines investing:

To commit (money) in order to earn a financial return. To make use of for future benefits or advantages.

The same dictionary defines gambling this way:

To play a game for money or property. To bet on an uncertain outcome. Take a chance.

Gambling games have odds. Those odds are calculable and become more accurate the longer a player plays.

Investing in the stock market is often compared to gambling, but investing is not a game.

Certain strategies are akin to gambling, like trading penny stocks, short-term speculation, and unprotected option strategies.

Those strategies should be avoided.

Properly investing in stocks, on the other hand, involves the thorough analysis of real-world data.

The stock market favors long-term investors and there is no house. The longer the period of time you invest, the more likely you’ll make money, unlike gambling.

From day-to-day, who knows what the market or any individual stock will do. But the long-term average annual increase of the S&P 500 Index is about 9%.

As your investment time horizon increases, so does your chances of earning 9%, especially if you’re investing in low-cost index funds and Dividend Aristocrat stocks in retirement accounts.

Another major difference between investing and gambling is ownership. When you buy a stock, you become a part-owner of a business. That business sells products and services, earns revenue, pays dividends, and has intrinsic value.

The company trades on a marketplace which fluctuates day-to-day, sometimes dramatically. But if you consider your investments as part of a long-term business instead of a risky bet on daily stock directions, you’ll be more likely to succeed.

With gambling, you’re nearly guaranteed to eventually lose. The math tells us so. Investing vs. gambling are not like each other at all.

Your Money or… Your Life

A giant $1.4 billion casino recently opened not far from my house. The evening of the grand opening, helicopters from the local news stations hovered all night above the massive traffic jam keeping awake nearly every child in our zip code.

For three years, I commuted past the construction site monstrosity almost every day as it was being built.

My wife and I waited a few months before visiting one of the casino restaurants on a rare date night.

Knowing my love of casinos and gambling (and respect for the math), I declared that I would never bet a dollar in that place. It’s too close, and gambling addiction is too dangerous.

I recently learned that someone I know ruined his financial life by spending it all at a local casino. At his age, he should be retired.

At this stage in my life, I’m confident that I have enough self-discipline to avoid becoming a gambling addict. But why risk it when the casino is so near? I’ve lost money at the blackjack table and quit, only to return a few hours later in hopes of winning it back.

I didn’t.

The Force is strong in casinos. An addiction would quickly become the greatest risk to my early retirement goal. It’s not worth testing the waters so close to home.

I’ll save my strict gambling budget for the next time I’m in Las Vegas or Atlantic City. As a suburban Dad with zero single friends, I don’t expect that invitation any time soon.

Do you like to gamble? What’s your take on investing vs. gambling?

Photo by ThomasWolter via Pixabay

Favorite tools and investment services right now:

Credible - NOW is the best time ever to refinance your mortgage and save. Credible makes it painless.

Personal Capital - A free tool to track your net worth and analyze investments.

M1 Finance - A top online broker for long-term investors and dividend reinvestment (review)

Fundrise - The easiest way to invest in high-quality real estate with as little as $500 (review)

Podcast: Play in new window Download

LISTEN (mp3audio) (5:45 min)

Right before the 2010 Super Bowl, a page 1 article in the February 5, 2010 Wall Street Journal opened with this sentence:

“Investors are sometimes accused of treating the stock market like a casino. Now, one Wall Street firm wants to treat casinos like the stock market.”

The article details the decision of a Wall Street bond-trading company to take over the management of sports betting at a new Las Vegas casino. Lee Amaitis, the company executive who runs the betting operation, says the firm got into sports gambling because “we wanted to turn gamblers into traders.” Using sophisticated financial-markets software, bettors can not only bet on the final outcome, but also make wagers on events during the game, such as whether the next pass might be completed, or who kicks next field goal.

On several occasions, the article noted similarities between investing and gambling. The article even featured a bond trader-turned-professional gambler who said “Wall Street is just a form of legalized gambling.”

Is investing just a form of gambling? For many investors, the answer may be “yes.” But it doesn’t have to be. And it probably shouldn’t be.

In July 2000, Tom Murkco, the CEO of Investor-Guide.com, published an essay titled “What is the difference between gambling and investing?” While Murkco noted that many aspects of gambling and investing might appear similar, there were several distinct and easily defined differences.

For either investing or gambling, the beginning of Murkco’s definition is the same: An activity in which money is put at risk for the purpose of making a profit.

But while the purpose of gambling and investing is identical, the methods by which the purposes are achieved are drastically different.

Here are Murkco’s distinctions:

Difference Between Investment Speculation And Gambling In Tabular Form

When someone invests…

- sufficient research has been conducted;

- the odds are favorable;

- the behavior is risk-averse;

- a systematic approach is being taken;

- emotions such as greed and fear play no role;

- the activity is ongoing and done as part of a

- long-term plan;

- the activity is not motivated solely by entertainment or compulsion;

- ownership of something tangible is involved;

- a net positive economic effect results.”

When someone gambles…

- little or no research has been conducted;

- the odds are unfavorable;

- the behavior is risk-seeking;

- an unsystematic approach is being taken;

- emotions such as greed and fear play a role;

- the activity is a discrete event or series of discrete events not done as part of a long-term plan;

- the activity is significantly motivated by entertainment or compulsion;

- ownership of something tangible is not involved;

- no net economic effect results.

When defined this way, it’s easy to see the differences between investing and gambling. It’s also easy to see that because of the methods some people use to invest, their behavior may more closely resemble gambling.

For example, industry studies have repeatedly shown that the behavior of mutual fund investors often accounts for poor investment performance. Because they don’t approach investing systematically, emotions like greed and fear may cause people to make impulsive decisions, with little or no research. Not surprisingly, the results from these methods more often resemble the returns from lottery tickets.

Not Gambling with Your Investments: Easier said than done?

In his book, Snap Judgment: When to Trust Your Instincts, When to Ignore Them, and How to Avoid Making Big Mistakes With Your Money,author David Adler says it’s the psychological component of investing that is the most difficult to manage. Adler contends that behavioral research shows many individuals have an almost over-whelming set of hard-wired dispositions to take gambles rather than make investments. Adler quotes Andrew Lo, an MIT professor of finance:

“The same neural circuitry that responds to cocaine, food, and sex has been shown to be activated by monetary gain as well.”

Difference Between Gambling Investment And Speculation

For some people, the thrill of investing/gambling can be addictive. But when the stakes are one’s financial future or retirement, or your children’s college education, the need for a thrill shouldn’t come by jeopardizing one’s investments.

This imperative to not compromise investing by gambling highlights one of the greatest benefits of working with a team of financial professionals: Besides receiving informed advice, a financial professional can often serve as a protection against gambling with your investments, by encouraging you to make sound decisions based on good research that have a high likelihood of success.

Difference Between Investment And Gambling Slideshare

Take a moment to consider the last few major financial decisions you’ve made in the past year. Then look at the list above. Did you make an investment or take a gamble?